2024 Hsa Limits Explained For Employers

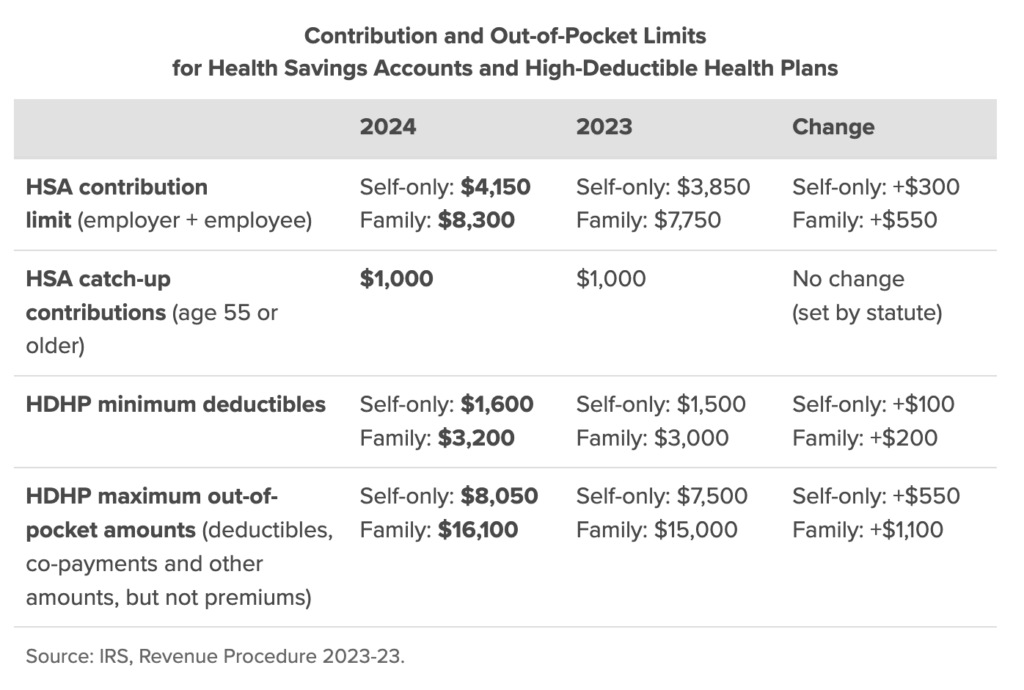

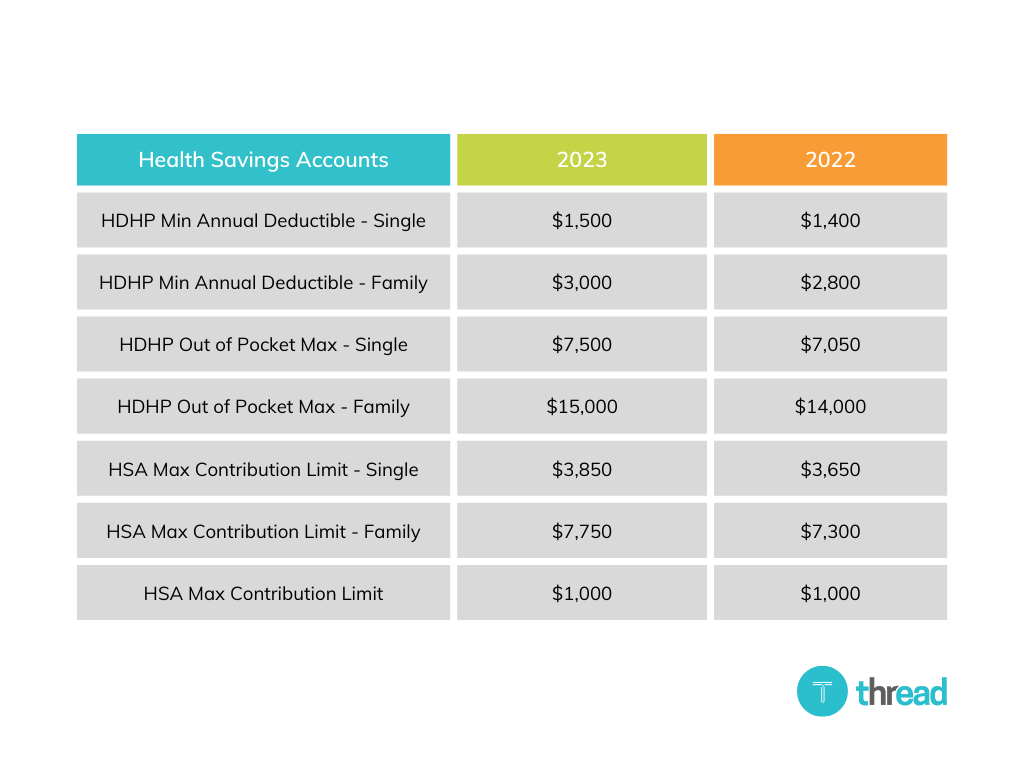

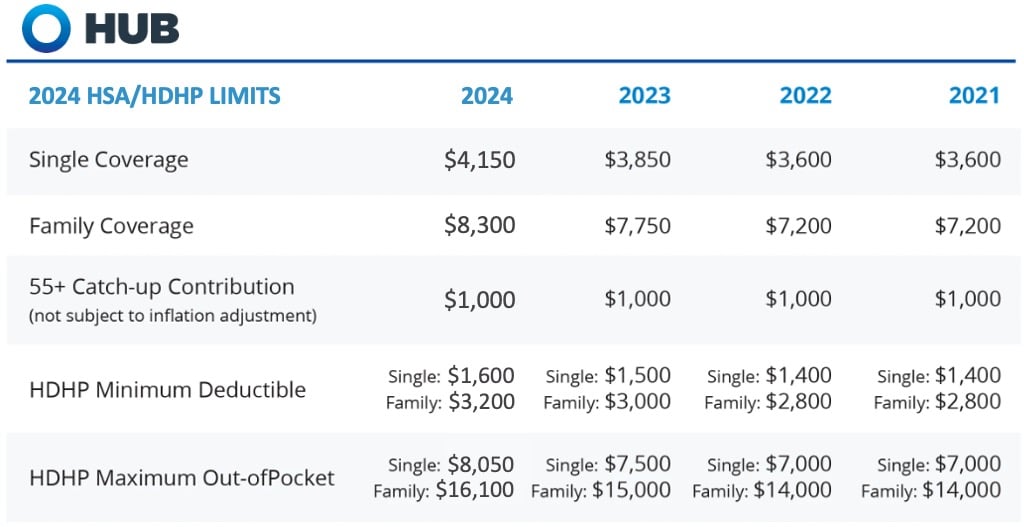

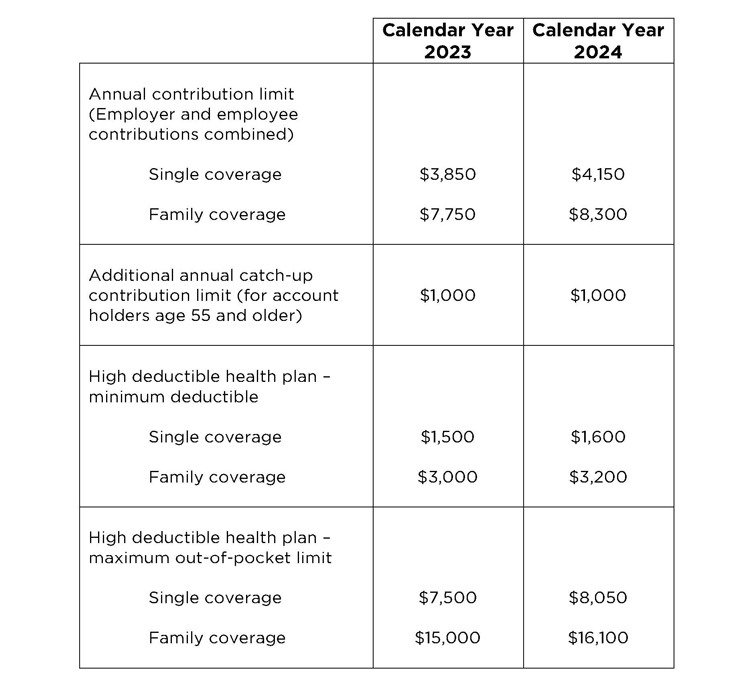

2024 Hsa Limits Explained For Employers. The hsa contribution limits for 2024 are $4,150 for individuals and $8,300 for families. The hsa contribution limits for 2024 are $4,150 for individuals and $8,300 for families.

The 2024 contribution limit is $4,150 for. The hsa contribution limits for 2024 are $4,150 for individuals and $8,300 for families.

Deductible Minimum That Qualifies For An Hsa:

For fsas, the employee contribution cap will undergo a 5% increase, rising from $3,050 to $3,200.

This Compliance Overview Summarizes Key Features For Hsas, Including The Contribution Limits For 2024.

$3,200 for family coverage (currently, it’s.

2024 Hsa Limits Explained For Employers Images References :

Source: www.cbiz.com

Source: www.cbiz.com

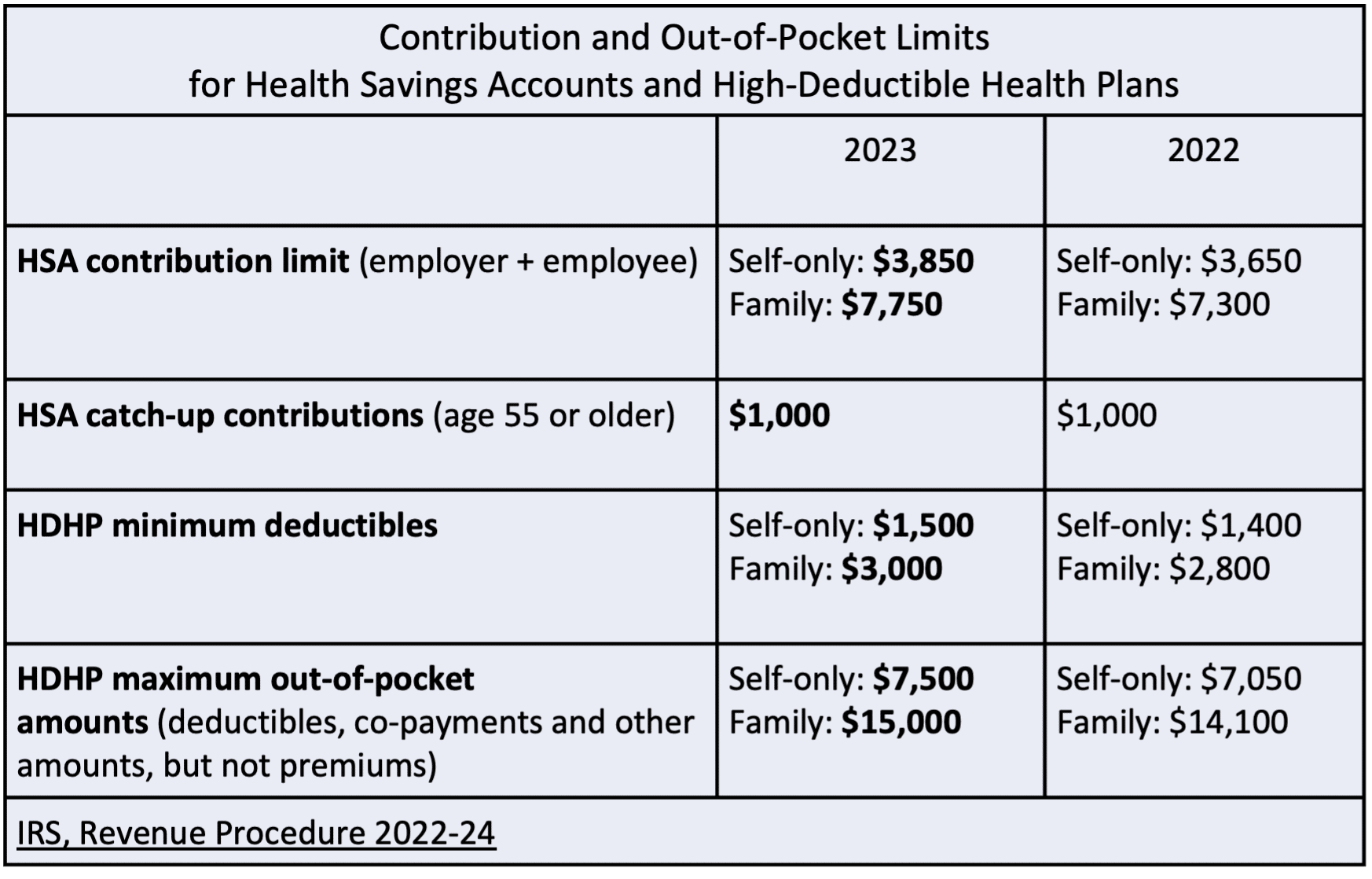

2024 HSA & HDHP Limits, What are the hsa contribution limits for 2024? However, those 55 and older can.

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2024 HSA Contribution Limits Claremont Insurance Services, For fsas, the employee contribution cap will undergo a 5% increase, rising from $3,050 to $3,200. Employers may need to update their enrollment materials and communicate the new.

Source: ellynnqguenevere.pages.dev

Source: ellynnqguenevere.pages.dev

Hsa Limits 2024 Include Employer Contribution Nesta Adelaide, The 2024 contribution limit is $4,150 for. Employers may need to update their enrollment materials and communicate the new.

Source: liliakarrie.pages.dev

Source: liliakarrie.pages.dev

2024 Hsa Limits Explained By Employer Nanny Violante, However, those 55 and older can. The hsa contribution limits for 2024 are $4,150 for individuals and $8,300 for families.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, Individuals enrolled in an hdhp can contribute $4,150, a 7.8% increase from. Employers may need to update their enrollment materials and communicate the new.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, What are the hsa contribution limits for 2024? Employers have the choice to permit carryovers, and for 2024, the limit is ascending from $610 to $640.

Source: linaqnalani.pages.dev

Source: linaqnalani.pages.dev

Hsa Contribution Limits For 2024 Employer Deni, If you’re eligible for one, it’s important to follow the 2024 hsa contribution. This compliance overview summarizes key features for hsas, including the contribution limits for 2024.

Source: ettaqloraine.pages.dev

Source: ettaqloraine.pages.dev

Irs Guidelines For Hsa 2024 Belva Kittie, Deductible minimum that qualifies for an hsa: If you have family coverage, you can.

Source: www.peoplekeep.com

Source: www.peoplekeep.com

2024 HSA contribution limits, For fsas, the employee contribution cap will undergo a 5% increase, rising from $3,050 to $3,200. The hsa contribution limit for family coverage is $8,300.

Source: news.hanysbenefits.com

Source: news.hanysbenefits.com

2024 HSA and HDHP Limits Free Chart, The hsa contribution limit for family coverage is $8,300. Individuals enrolled in an hdhp can contribute $4,150, a 7.8% increase from.

However, Those 55 And Older Can.

Deductible minimum that qualifies for an hsa:

The 2024 Contribution Limit Is $4,150 For.

The adjusted contribution limits for hsas take effect as of january 1, 2024.

Posted in 2024